In today’s fast-paced world, managing finances can be a daunting task. Whether it’s unexpected expenses, late bill payments, or the need for a little extra cash before your next paycheck, financial challenges are common. This is where apps like Brigit come into play, offering a range of solutions to help individuals gain more control over their finances. While Brigit is a popular choice, there are several alternatives worth exploring to cater to diverse financial needs. Here’s an in-depth look at various apps similar to Brigit that can assist in better financial management.

What is Brigit?

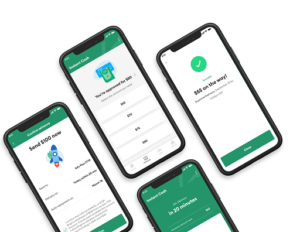

Brigit is a financial wellness app designed to help users avoid overdraft fees, late payment penalties, and unexpected expenses. With its features, such as interest-free cash advances, account monitoring, and financial planning tools, Brigit has gained popularity for providing financial support between paychecks.

Features of Brigit

- Interest-free Cash Advances: Users can access cash advances without incurring interest, providing a cushion during financial emergencies.

- Account Monitoring: Brigit monitors linked bank accounts, analyzing spending patterns and providing insights for better financial planning.

- Financial Planning Tools: It offers budgeting tools, bill payment reminders, and spending analysis to help users manage their money effectively.

Alternatives to Brigit

- Dave

- Key Features: Similar to Brigit, Dave offers interest-free cash advances, budgeting tools, and alerts for upcoming expenses.

- Differentiator: Dave offers the “Side Hustle” feature, allowing users to access short-term job opportunities to earn extra income.

- Earnin

- Key Features: Earnin enables users to access a portion of their earned wages before payday without fees or interest.

- Differentiator: The app utilizes a “Tip What You Think Is Fair” model, allowing users to tip what they think is reasonable for the service.

- Albert

- Key Features: Albert offers cash advances, budgeting, savings recommendations, and investment advice.

- Differentiator: Provides holistic financial advice and personalized recommendations for saving and investing.

- MoneyLion

- Key Features: MoneyLion offers cash advances, credit builder loans, investment services, and a rewards program for improving financial health.

- Differentiator: Its “Credit Builder Plus” membership helps users improve their credit score through credit monitoring and reporting to credit bureaus.

- Chime

- Key Features: Chime offers a no-fee bank account, early direct deposit, savings account, and a roundup feature to save spare change.

- Differentiator: Users can access their paycheck up to two days earlier than traditional banks, easing financial stress.

How to Choose the Right App

When selecting an app similar to Brigit, consider the following factors:

- Fees and Interest: Look for apps that offer interest-free cash advances or have minimal fees.

- Features: Consider whether the app provides the specific features you need, such as budgeting tools, account monitoring, or investment advice.

- User Experience: Check app reviews and user experiences to ensure the app is user-friendly and reliable.

- Security: Ensure the app has robust security measures to safeguard your financial information.

Apps like Brigit and its alternatives offer valuable financial assistance, allowing users to manage their money effectively and avoid costly fees. Understanding the features and differences between these apps can help individuals choose the one that best aligns with their financial goals and requirements. Explore these alternatives to Brigit to find the right financial management solution that suits your needs.